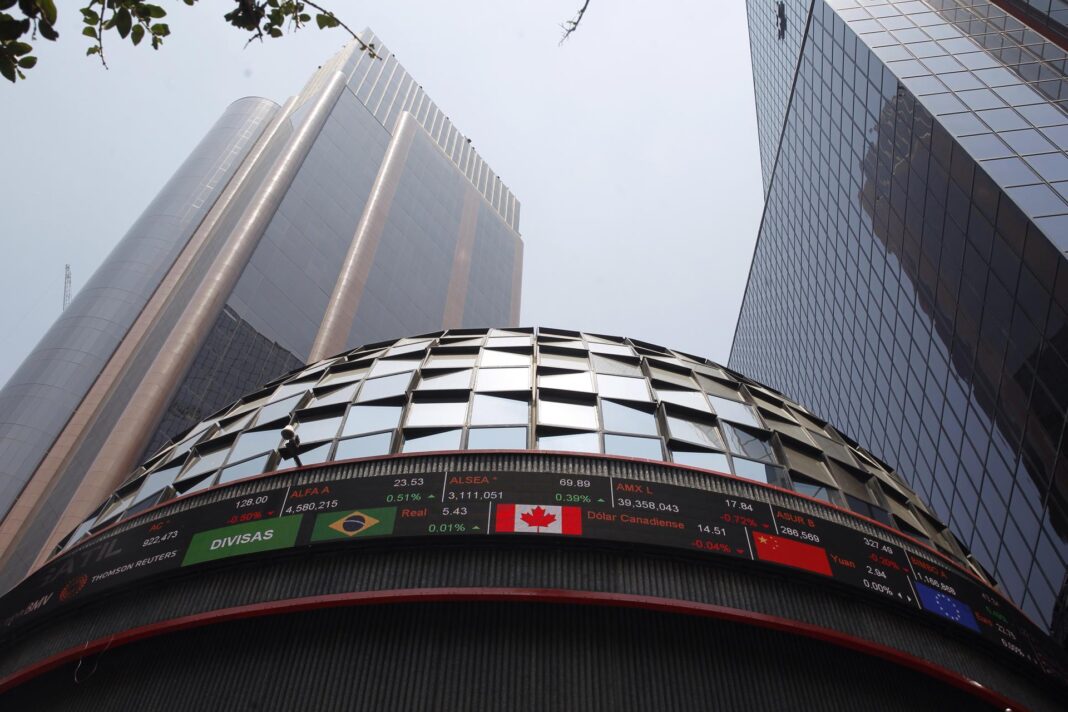

Mexico City.- The Mexican Stock Exchange (BMV) recorded its third consecutive intraday decline this Friday and accumulated a loss in the third week of September of -0.97%, which broke a streak of four consecutive weekly advances.

This Friday alone, the Price and Quotations Index, the main indicator of the BMV, suffered a correction of -0.2% to stand at 61,200.27 units, after reaching a new historical high of 62,102.13 on Monday, September 15th.

Nationals

Abinader shares with the Dominican community in the United Arab Emirates

United Arab Emirates.- Within the framework of his official agenda in the United Arab Emirates, President Luis Abinader held a close and special meeting with Dominican citizens residing in that country, with whom he discussed their experience abroad, their projects, and the development that the nation is experiencing. “I always like to share and feel […]

Dominicans will be able to travel to Mongolia without a visa after a new diplomatic agreement

SANTO DOMINGO – The governments of the Dominican Republic and Mongolia have formalized a visa waiver agreement that will allow citizens of both countries to travel without the need for this document. According to diplomatic note DU/TI-051162, issued by the Ministry of Foreign Affairs (MIREX), the measure applies to holders of ordinary, diplomatic and official […]

Unicef states that more than 63% of Dominican children have suffered violence at home

Santo Domingo.- The office in Santo Domingo of the United Nations Children's Fund (Unicef) said this Tuesday that more than 63% of children aged 1 to 14 years old have been subjected to violent methods of discipline at home. The prevalence increases in childhood from 3 and 4 years old, where these practices reach 70%, […]

Electric shock kills couple in front of their children at construction site in Moca

Moca, Espaillat province.– A couple lost their lives instantly after receiving an electric shock while carrying out construction work in the community of Guausi, municipality of Moca, in an event that has generated deep consternation both in the accident area and in their place of residence, in Santiago. The victims were identified as Ligia María […]

Mother requests help to cover vital study costs prior to her baby's heart surgery

Santo Domingo.- Marienny Villar, mother of little Lucas David, made a call for solidarity from the population to raise funds to cover the cost of a genetic study indispensable before her son undergoes surgery for congenital heart disease. Villar explained that his son was diagnosed from an early age with this heart condition and that, […]

Sports

Bad Bunny understands that the Super Bowl is a platform for unión, says the NFL boss

The commissioner of the National Football League (NFL), Roger Goodell, has assured that the Puerto Rican singer Bad Bunny is aware that the Super Bowl is a platform that promotes unity. «He understands that the Super Bowl platform serves to unite people with their creativity and talent and that he must take advantage of this […]

Abinader urges Leones champions to compete with "patriotism" in the Caribbean Series

Santo Domingo.- The Dominican president, Luis Abinader, received this Thursday players from the Leones del Escogido, champions of the Dominican Republic Professional Baseball League, whom he urged to compete with "patriotism" as representatives of the country in the Caribbean Series to be held from February 1 to 7 in Jalisco, Mexico. The ruler handed the […]

Bayaguana Sports Union Highlights Charlie Mariotti's Legacy in the Development of Monte Plata

Bayaguana, Monte Plata.– The president of the Bayaguana Sports Union, Isaac Ogando, acknowledged the contributions made by Charlie Mariotti, candidate for the presidential candidacy of the Dominican Liberation Party (PLD), to the strengthening of the municipality of Bayaguana and the province of Monte Plata, underlining his constant support for sports and community initiatives for several […]

José Monegro highlights sports as a key axis to strengthen Dominican tourism at FITUR

Madrid, Spain.– Within the framework of the International Tourism Fair (FITUR), the president of the Organizing Committee of the Central American and Caribbean Games, José Monegro, stated that the integration of sports and major events into the national tourism strategy consolidates the Dominican Republic as a comprehensive, competitive, and diversified destination. You may be interested […]

Eagles call the cancellation of the game against the Bulls excessive

Santiago.– The Águilas Cibaeñas team called the decision by the Dominican Professional Baseball League (LIDOM) to annul the game they won last Friday against the Toros del Este surprising and disproportionate, after the latter team requested the confiscation of the game alleging a supposed violation of the limit of imported players allowed on the roster. […]

Technology

ChatGPT goes down globally

ChatGPT surprised thousands of users this Tuesday, February 3, by presenting failures in its operation, without prior notice. High error rates are occurring in adjustment jobs. "And we have identified that users are experiencing high levels of error in the affected services," OpenAI wrote on its website. "We have identified the problem and applied the […]

Meta and YouTube face a historic trial over accusations of youth addiction

Los Ángeles.- Los dos gigantes tecnológicos Meta y YouTube enfrentan esta semana un histórico juicio en el estado de California por acusaciones de que sus plataformas alimentan una crisis de adicción juvenil. The trial will take place in the Los Angeles County Superior Court and marks the first time the companies will present their case […]

Microsoft unveils Maia 200, its new AI chip to compete with those of Google and Amazon

Technology

EFE -

0

New York.- The tech giant Microsoft presented this Monday Maia 200, the second generation of its artificial intelligence (AI) chip with which it seeks to reduce dependence on Nvidia and compete against those of Google and Amazon in the cloud. This new model has been presented two years after its first version, the Maia 100, […]

Larry Ellison, co-founder of Oracle, adds TikTok's algorithm to his media empire.

New York.- Billionaire Larry Ellison, co-founder of Oracle, one of the most ruthless figures in Silicon Valley and the new 'czar' of the media in the United States, managed to become the guardian of the algorithm of the renewed American TikTok. Ellison, who is 81 years old and lives on the Hawaiian island of Lanai […]

Blue Origin will launch a satellite network to serve governments and data centers

Technology

EFE -

0

New York.- Blue Origin, the space company of Amazon founder Jeff Bezos, announced this Wednesday that it plans to launch a network of 5,408 satellites by the end of 2027 to provide high-speed internet service to governments, data centers and companies. The satellite network, called TeraWave, is designed to offer "symmetrical data speeds of up […]

International

Delcy Rodríguez says Venezuela is in "calm" after a month of the US attack

Caracas.- The acting president of Venezuela, Delcy Rodríguez, assured this Tuesday that the country is in "calm" after a month of the attack by the United States in Caracas and neighboring states, an operation that ended with the capture of President Nicolás Maduro and his wife, Cilia Flores. "The country is calm. The country is […]

US removes thousands of Epstein documents after disclosing victim information

Washington.- The U.S. Department of Justice removed thousands of documents related to the Jeffrey Epstein case from its website this Tuesday, after it was reported that the identity of the victims had been compromised. The Justice Department told U.S. media that it removed the affected documents due to "technical or human errors" and assured that […]

Petro denies having asked Trump to lift the sanctions

Washington - Colombian President Gustavo Petro denied this Tuesday having asked US President Donald Trump to remove him from the list of the Office of Foreign Assets Control (OFAC), known as 'Clinton List', which entails financial sanctions for the president. "I didn't ask that. You know what my life was like. For a good part […]

Venezuela will send the US "thousands" of letters in support of Nicolás Maduro and his wife

Caracas.- The Government of Venezuela will send what it assured are "thousands" of letters of support to the Venezuelan president, Nicolás Maduro, and his wife, Cilia Flores, who remain detained in the United States after being captured in Caracas a month ago, reported this Tuesday Camilla Fabri, the president of the Misión Vuelta a la […]

Trump: "Epstein conspired against me"

U.S. President Donald Trump claimed that the deceased sex offender Jeffrey Epstein conspired against him with the aim of harming him politically and causing his electoral defeat, or "something worse," as he expressed in public statements released this Tuesday. "Epstein conspired against me. They conspired against me so that I would lose the election, or […]

Entertainment

"Acroarte's Eggs" in the 2026 Soberano nominations

Santo Domingo, DR - The Association of Art Journalists (Acroarte) announced this Tuesday the nominees for the 41st edition of the Soberano Awards, an award expected by the Dominican artistic class, which celebrates being considered year after year in the categories of cinema, classical music, popular music, and communication. However, as happens every year, beyond […]

Diego Jaar reaches his third nomination for Soberano Awards

SANTO DOMINGO – Dominican singer-songwriter Diego Jaar enthusiastically receives his third nomination for the Soberano Awards 2026 in the "Solo Artist" category, solidifying a stage of artistic maturity and deep connection with his audience. After a 2025 marked by milestones in the popularity charts, Jaar reaffirms his position as one of the most authentic and […]

Santiago Matías and Isaura Taveras raise the "white flag" after a call on Alofoke Radio Show

Santo Domingo, RD - After a prolonged rivalry that escalated to the courts and was recently definitively archived, businessman Santiago Matías (Alofoke) and communicator Isaura Taveras gave public signs of reconciliation by holding a live telephone conversation during Alofoke Radio Show, where both agreed on the need to turn the page and leave the differences […]

“The Great Opportunity”: A documentary that invites us to question the country we are

Santo Domingo. From the language of documentary cinema, RD Positiva bursts into the public debate with a work that bets less on closed answers and more on the necessary questions. "The Great Opportunity," which will premiere next Sunday at the Eduardo Brito National Theater, at 8:30 pm, is presented as an audiovisual exercise of memory, […]

From Alofoke's House to the Soberano Awards: Gigi Achieves Nomination at Premios Soberano

Santo Domingo, RD - Digital content creator and urban music interpreter Angélica Gutiérrez, better known as La Gigi, has been one of the big surprises in the announcement of the nominations for the 41st edition of the Soberano Awards. La Gigi, one of the most outstanding participants of the first season of the reality show, […]

Opinion

The new crisis doesn't start in the media, it starts on WhatsApp

A country can ignite from a chat: WhatsApp sets the agenda before the media. A single forward surpasses any headline. In the digital age, the real information crisis doesn't ignite in the newsrooms of a media outlet, nor on the front pages of newspapers: it begins in a simple WhatsApp chat. Before any media outlet […]

When corruption is not protected by the presidential band

In the Dominican Republic, presidents don't fall because of the opposition. They fall because of something more intimate and devastating: their own family. When corruption shares the same last name as the presidential band, it ceases to be a case and becomes a sentence. It's not a contract that is judged: it's the entire credibility […]

We have a permanent constitutional back and forth

In 2015, an internal crisis within the Dominican Liberation Party (PLD) forced the leadership of that organization to promote a constitutional reform to enable President Danilo Medina, who had been elected in 2012 through a constitution that prohibited consecutive re-election. Medina was eligible to try to return in 2020, that is, after a period, a […]

When the slander is coordinated and clumsy

For days, Leonardo Aguilera has been the target of a campaign as evidently coordinated as it is poorly executed. Defamation, slander, and half-truths circulate on networks and certain media with suspicious synchronicity. Who's sending them? Who's biting their nails? The formula is old: fabricate scandals where they don't exist, repeat lies until they seem like […]

The TV changed in DR

In 2025, live news streaming via YouTube on smart TVs leaves traditional television behind and transforms news consumption in the Dominican Republic.By: Pavel De Camps Vargas Who's dominating your home screen today? It's not traditional television. In the Dominican Republic, YouTube has taken over the television in this 2025, redefining the map of news consumption. […]

Economy

Daniel Toribio warns that the regional advantage is evaporating: We grew less and food went up more

Santo Domingo.- Economist Daniel Toribio warned that the Dominican Republic closed 2025 with a worrying turn compared to Central America: it went from leading the regional growth to lagging behind, while food inflation continued to strongly pressure low-income households. Toribio pointed out that, according to the comparative performance, in 2025 several countries in the region […]

In 2025, foreign investment reached $5.032 billion, 11.3% more than in 2024

Santo Domingo.- The Central Bank of the Dominican Republic (BCRD) reported this Sunday that, according to preliminary figures, foreign direct investment (FDI) reached 5,032.3 million U.S. dollars at the end of 2025, which represented an increase of 509.1 million, 11.3% more, compared to 2024. By sector, half of the FDI revenue went to the tourism […]

Gasoline, diesel, and LPG prices will remain unchanged

Santo Domingo.- Mass consumption fuels, such as gasoline, diesel and propane gas, will maintain their prices for the week of January 31 to February 6, the Ministry of Industry, Commerce and Mipymes (MICM) reported this Friday. Premium gasoline will remain at 290.10 pesos per gallon and regular at RD$272.50 per gallon. You may be interested […]

The euro continues to fall and drops to $1.1899

Berlin.- The euro was trading at 1.1899 dollars this Friday, below the barrier of 1.1900 dollars, on a day marked by negative employment data in Germany, the largest European economy, with 3,085,000 unemployed, the highest figure since 2014. The community currency was trading around 4:00 PM GMT at 1.1899 dollars, compared to 1.1926 dollars the […]

Trump nominates Kevin Warsh to replace Jerome Powell as head of the Federal Reserve

Washington.- The US President, Donald Trump, announced this Friday that he has nominated the American banker and economist Kevin Warsh to chair the Board of Governors of the Federal Reserve to replace Jerome Powell. "I am pleased to announce that I am nominating Kevin Warsh" to chair the Federal Reserve, Trump said on the Truth […]

Style

Brisas de las Colinas maintains an upward pace after completing the first stage

Santo Domingo.- The Brisas de las Colinas housing project has sparked considerable interest in the real estate market, registering more than 300 interested clients and securing more than 100 reservations in a single day, which allowed the complete sale of its first stage and the immediate start of the commercialization of the second phase, with […]

Announcing the First Regional Book and Culture Fair Cibao from April 20 to 26

Santiago.– The Ministry of Culture announced this Wednesday the main guidelines of the Cibao Regional Book and Culture Fair, conceived as a space to celebrate reading, thought, and the cultural richness of the north of the country, with the participation of the 14 provinces of the region. The first fair edition will be held on April […]

A two-year-old boy breaks two Guinness World Records in billiards

London.- A two-year-old boy from Manchester has broken two Guinness World Records for billiards by performing two tricks that no one had done before at such a young age. Jude Owens performed a first trick, called "pool bank shot" at two years and 302 days old and another called "snooker double pot" at two years […]

Today marks the 213th anniversary of the birth of Juan Pablo Duarte

Santo Domingo.– This Monday, January 26th, the Dominican Republic commemorates the 213th anniversary of the birth of Juan Pablo Duarte, Father of the Nation and main ideologue of National Independence, whose thought and sacrifice laid the foundations of the Republic proclaimed on February 27, 1844. Juan Pablo Duarte was born on January 26, 1813, in […]

OK Casting Award will celebrate its second edition in virtual format on January 31, 2026

Santo Domingo, RD.– The agency OK Casting announced the celebration of the second edition of the OK Casting Award, which will be held in virtual format on January 31, 2026, consolidating itself as a platform for promotion, training and visibility for acting talents in audiovisual productions of television and cinema in the Dominican Republic. The […]

Editorial

Development for the border

If anything has been highlighted by the prolonged Haitian crisis, it is the historical debt that the Dominican Republic has with its own border. The provinces that guard that line of more than 390 kilometers not only face the direct consequences of the collapse of the Haitian state, but have also been, for decades, forgotten […]

Tourism continues to grow

Without a doubt, the tourism sector represents one of the greatest successes of the governments of President Luis Abinader, an area that he already knew well before his arrival at the Presidency of the Republic, due to his experience as a local businessman. Since his swearing-in in August 2020, the Tourism Cabinet was implemented, coordinated […]

The Independence of July 4th

This July 4th, the United States commemorates the 249th anniversary of its independence, a date that marks the beginning of a nation forged in the fight for freedom, civil rights, and self-determination. Since then, this feat has been celebrated in multiple cultural expressions that exalt patriotic pride and the sense of national belonging. However, on […]

Four years reporting for you

Today we proudly and gratefully celebrate the fourth anniversary of De Último Minuto, a project that was born with the firm conviction of transforming the way information is reported in the Dominican Republic. In these four years, we have witnessed —and been protagonists— of a revolution in digital journalism, marked by immediacy, technological innovation, and […]

We are connected to the present, focused on the future

On the eve of celebrating the fourth anniversary of De Último Minuto, we reaffirm our commitment to innovation, technology and, above all, to you: our readers. We are driven by the constant desire to evolve, to do things differently and to keep up with the times. Therefore, today we present two new products that will […]

De Último Minuto

The Truth Newspaper - A media outlet of Alofoke Media Group

© 2025 De Último Minuto. All rights reserved.

Spanish

Spanish